- 281.367.2220

- info@jbeardcompany.com

- Mon - Fri: 8:30 AM - 5:30 PM

State of The Class A Office Market in The Woodlands

The Howard Hughes Corporation recently made news in The Woodlands’ office submarket with their acquisition of the two former Anadarko Towers, known as the Allison and Hackett Towers, which total approximately 1.36 million square feet. As part of the transaction, Occidental Petroleum intends to occupy the entirety of the 808,000 square feet in the Allison Tower under a 13-year leaseback which makes the building a non-owner singletenant occupied building. However; the larger impact to the submarket fundamentals will be the 550,000 square feet in the Hackett Tower which will be made available for direct lease.

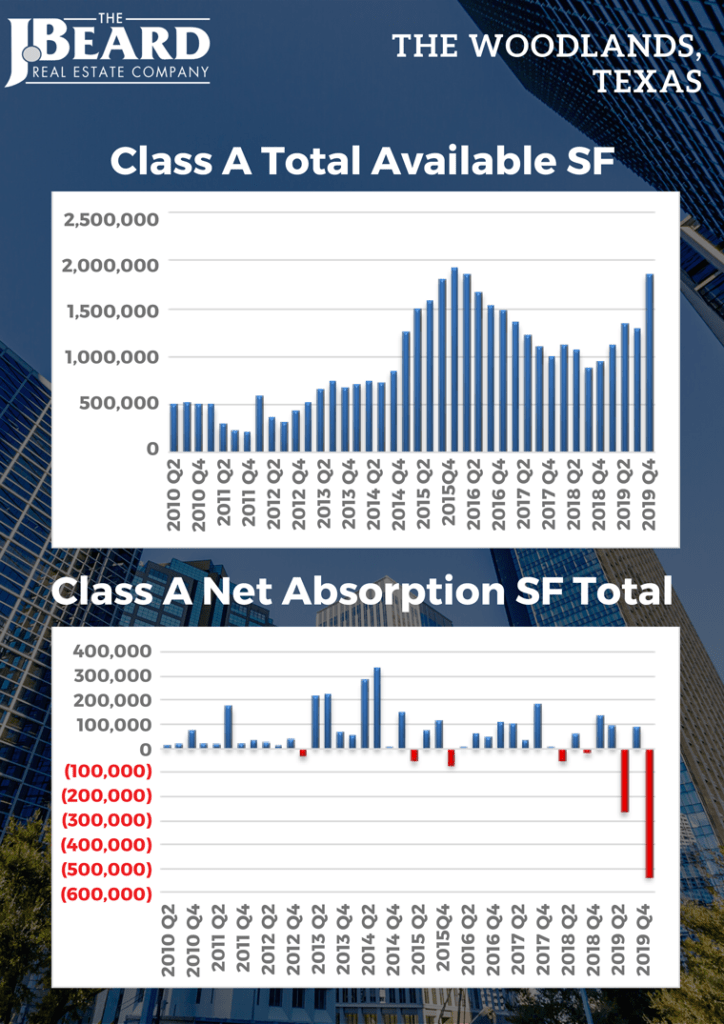

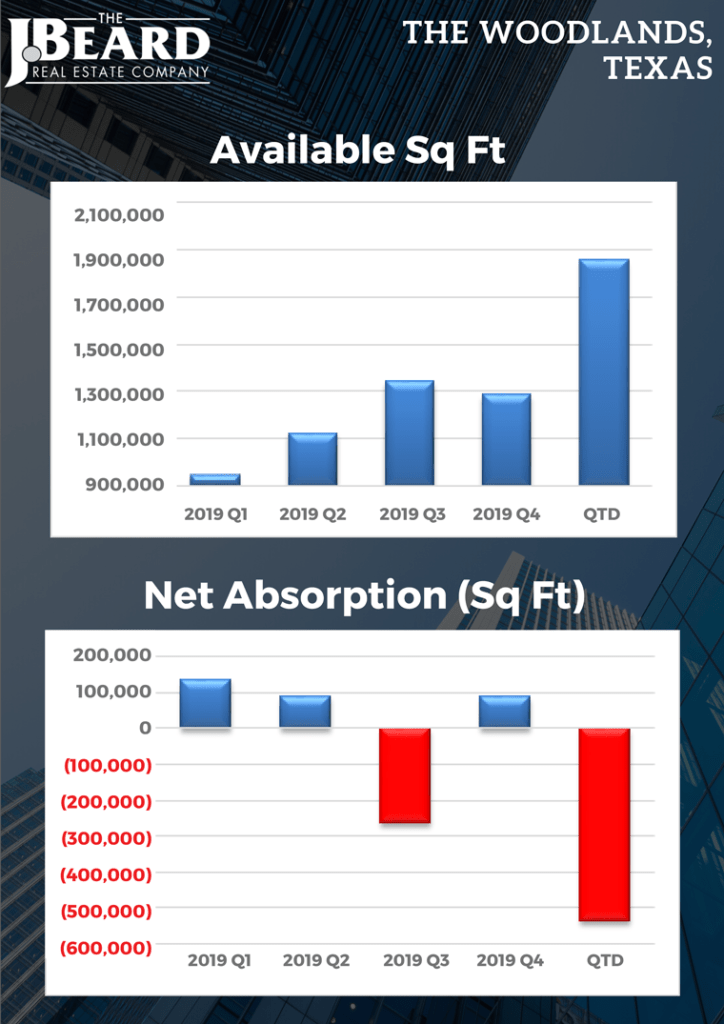

As a result of this event, the total available class A space in The Woodlands has increased to nearly 1.9 million square feet which is an increase of 45% when compared to the previous quarter. While the impact on supply is important to understand, the greater question will be related to the demand in the market and the velocity in which occupancy returns to its most recent level.

The previous 24-month net absorption prior to the introduction of this new space was a total of 291,674 square feet which equates to an average of approximately 40,000 square feet per quarter. If the submarket were to operate in a statistical vacuum, it could be hypothesized that the market would take slightly more than three years to return to the occupancy levels prior to the news. However; The Woodlands’ submarket has historically been, and remains, a highly sought after business location. Large tenants relocating from other Greater Houston submarkets or corporate relocation from outside markets may expedite the recent absorption trends.

Subscribe to our Newsletter

To receive similar articles and learn more about The J. Beard Real Estate Company.